Teaspoon to find Real estate: Armed forces users are widely used to high challengesbat trips, deployments, and you can constant transfers are a couple of the difficulties they deal with seem to. Due to this stress, many armed forces professionals experience significant struggles with regards to providing ahead economically.

Perhaps one of the primary benefits to You.S. government or armed forces provider is the Thrift Savings Package. The latest Thrift Discounts Plan (TSP) was senior years deals and you may financial support bundle open to most recent teams away from new army and government.

As the it is a beneficial laid out sum retirement plan, the latest retirement money you will get regarding Tsp depends on just how much your (plus service, in the event that relevant) contribute through your working agesalso how well your own assets do more that point. Though it also provides several advantages for later years savings, the new Teaspoon are an around-enjoyed and you may under-utilized work with provided by government entities.

Being a support representative will provide you with accessibility investment potential you to civilians dont. That’s a great thing! Meanwhile, of numerous services participants was young and haven’t had much specialized monetary degree, therefore navigating the newest resource options to dedicate is tough. Although both complicated, purchasing early is the vital thing to wide range! I am aware numerous resigned services members just who made it a spot to begin with early. They failed to simply have confidence in its old age, in addition to ordered rental qualities within the places where these people were stationed, and you will dedicated to nonexempt levels. Once two decades, these were in for existence.

As to the reasons Tsp To get A home?

After you make any funding, the fresh capital organization is browsing require some of one’s money as the a support commission; no body works best for free. New Teaspoon currently charge a help fee regarding 0.04%, which is probably the lowest there is anywhere in the new globe. Even directory loans, and that specific people swear are the most effective investments, ordinarily have solution fees at least twice as much as new Tsp. Really company-backed senior years coupons plans reaches minimum three to four minutes more costly than the Tsp.

The newest Tsp is additionally a taxation advantage. As Teaspoon is actually a tax-deferred or tax-accredited old-age system, you are making a deal with the fresh Internal revenue service that you won’t use this money unless you try close to retiring. Inturn, the latest Irs states it won’t tax your into the a fraction of that money. This will be among the many big offering points of any later years offers package. Which have old-fashioned Teaspoon benefits, you have made an income tax split now and you may spend taxation into the senior years. However, you make Roth Tsp efforts having shortly after-income tax cash. Therefore, you do not get an income tax split now, nevertheless the account expands income tax-100 % free typically. While doing so, their withdrawals during the retirement try income tax-totally free.

Can be an owning a home be financed playing with a teaspoon?

This new Tsp will be purchased a property with a few standards. The sole option is to utilize the cash to possess a residential financing, that is a residential property this package was located in while the an excellent number 1 quarters. In principle, one can rent two more bed rooms, which would qualify a financial investment. However, while nonetheless working, you happen to be capable transfer some of the Tsp loans to help you a keen IRA or solo 401k, and this both accommodate investing in a home. When you’re retired, the complete Tsp harmony are going to be transported.

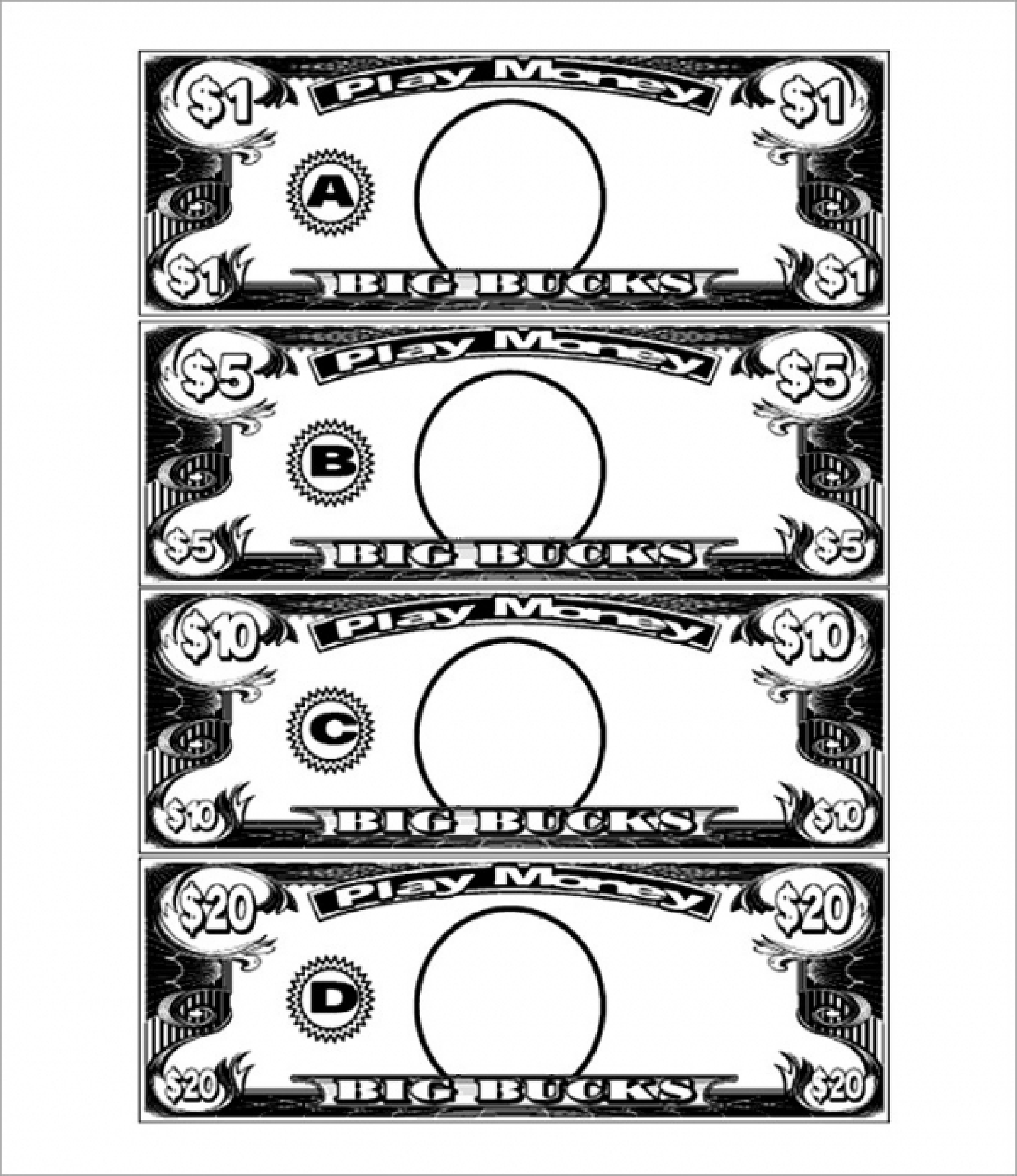

Borrowing from the bank up against your Tsp contributions is going to be an effective way to present a downpayment and you may settlement costs for your money spent. The mortgage is bound to your fund you have provided into Teaspoon membership perhaps not matching funds from their institution otherwise services and any accrued earnings. The loan amount have to be anywhere between $step one,100000 and you will $50,100000 and you can will get paid down on rate of interest into the G Finance during handling. A $50 processing payment will get set in the loan too.

Great things about To order an investment property having Teaspoon

Focus regarding a teaspoon financing becomes paid off for your requirements perhaps not a commercial bank and you may costs are pulled personally out of your salary. Once you pay your loan, your pay it back with attention. The new fees number will get placed back again to your Tsp membership and you will try spent based on the current share allowance. There is also the option in order to amortize the borrowed funds as needed to transform fees information such as extending this new payback several months for 15 years hence adjustments just how many costs or changes their count.

How does a tsp loan performs?

Financing repayments was reduced proportionally from the antique and you may Roth balances, and off for each Tsp money where you features expenditures. Applying for a teaspoon mortgage is simple so there are no denials for as long as there can be enough money in your account. For many who standard on your own Tsp mortgage, your borrowing from the bank actually impacted while the as the left equilibrium will get taxable income, the fresh standard isn’t claimed so you’re able to credit agencies. Before you take aside a teaspoon loan, ensure you’re not compromising the much time-label senior years desires by doing so. There are you are able to monetary effects https://elitecashadvance.com/loans/legitimate-online-loans/ to help you Tsp financing, together with being forced to delay old age so you’re able to replenish the nest egg. Tsp levels grow by way of benefits and you can compounded attract both of which was faster by the fund taken out against them. It is always necessary to dicuss in order to an economic counselor ahead of taking right out a tsp financing.

When you are underwriting potential business, range from the payment from the Tsp financing in the income investigation and you may finances beforehand towards payroll deduction. If this nonetheless is practical for your requirements whatsoever expenditures plus the loan payment, it could be an extraordinary possibility to fund forget the features.

While interested in much more about it and other sizes out-of passive money, go ahead and subscribe ADPI’s Myspace group. You will find lots off information and you may discussions to assist produce already been on your road to financial liberty.