Anything that can be quickly liquidated into cash is considered cash. Cash activities are a large part of any business, and the flow of cash in and out of the business is reported on the statement of cash flows. For accounting purposes, any form of cryptocurrency is considered an asset in the same way as a Renaissance painting. Accounts payable recognizes that the company owes money and hasnot paid. Remember, when a customer purchases something “onaccount” it means the customer has asked to be billed and will payat a later date. A business can now use this equation to analyze transactions inmore detail.

- Additional numbers starting with six and continuing might be used in large merchandising and manufacturing companies.

- It shows the effect of every transaction taking place and how it affects the corporation’s liabilities.

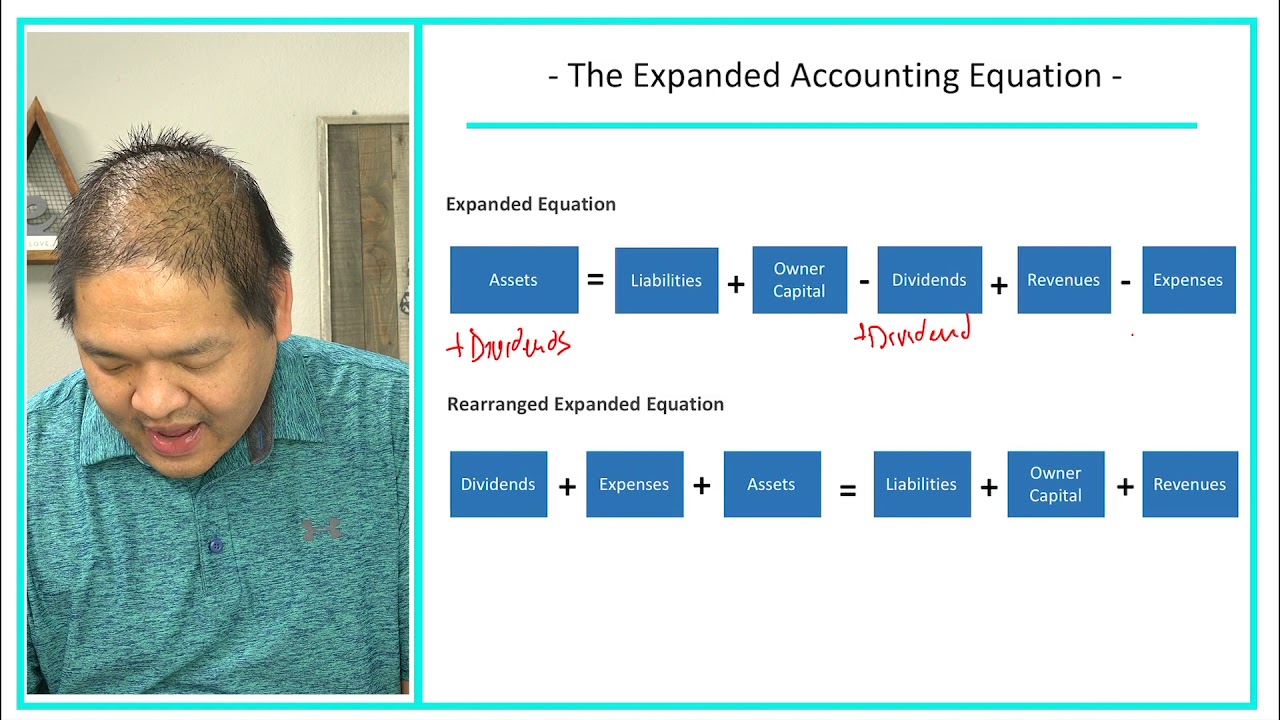

- Like the basic accounting equation, the expanded accounting equation shows the relationships among the accounting elements.

- Net income reported on the income statement flows into the statement of retained earnings.

Real-World Examples of the Expanded Accounting Equation

For example, a company may have accounts such as cash, accounts receivable, supplies, accounts payable, unearned revenues, common stock, dividends, revenues, and expenses. Each company will make a list that works for its business type, and the transactions it expects to engage in. The accounts may receive numbers using the system presented in Table 3.2. This expanded equation takes into consideration the components of Equity. Equity increases from revenues and owner investments (stock issuances) and decreases from expenses and dividends.

Yahoo Stock Portfolio – How Does it Work? Why Should I Use It?

Second, it can borrow the money from a lender such as a financial institution. You will learn about other assets turbotax and handr block fix irs error delaying stimulus checks to some customers as you progress through the book. Let’s now take a look at the right side of the accounting equation.

Passive Income Hacks to Cover Tuition Expenses While Studying

Let’s look at an example of the “expanded” accounting equation so we can better understand the concept. Expenses refer to the costs and expenses the company incurred to generate its revenues. Contributed capital and dividends show how much money has been injected by shareholders into the business and how much the business has paid out to shareholders. By practicing and analyzing your financial statements through this lens, you’ll gain a robust understanding of your business’s financial health—thus steering it toward growth and stability. While the traditional equation suffices for basic financial reporting, exploring the expanded version yields more significant insight into factors influencing your business profitability.

Cash activities are a large part ofany business, and the flow of cash in and out of the company isreported on the statement of cash flows. We begin with the left side of the equation, the assets,and work toward the right side of the equation to liabilities andequity. The accounts are presented in the chart ofaccounts in the order in which they appear on the financialstatements, beginning with the balance sheet accounts and then theincome statement accounts. Additional numbers starting with six andcontinuing might be used in large merchandising and manufacturingcompanies.

The accounting equation emphasizes a basic idea in business;that is, businesses need assets in order to operate. There are twoways a business can finance the purchase of assets. First, it cansell shares of its stock to the public to raise money to purchasethe assets, or it can use profits earned by the business to financeits activities. Second, it can borrow the money from a lender suchas a financial institution. You will learn about other assets asyou progress through the book. Let’s now take a look at the rightside of the accounting equation.

Regardless of how complex a transaction might be, the left side (Assets) will always equal the right one (Liabilities + Equity). As you dive further into business finance, there is an equation poised to become more than just numbers on a page for you. Access the contact form and send us your feedback, questions, etc. You can also contact us if you wish to submit your writing, cartoons, jokes, etc. and we will consider posting them to share with the world! The Facebook and LinkedIn groups are also good areas to find people interested in accounting like yourself, don’t hesitate to join as everyone of all levels are welcome to become part of the community.

Before we explore how to analyze transactions, we first need to understand what governs the way transactions are recorded. Before we explore how to analyse transactions, we first need to understand what governs the way transactions are recorded. Before we explore how to analyze transactions, we first need tounderstand what governs the way transactions are recorded. For another example, consider the balance sheet for Apple, Inc., as published in the company’s quarterly report on July 28, 2021. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

Additionally, it also reflects the particular effects of specific transactions in which owner or shareholder investments are involved, including interest, withdrawals, or dividends. For instance, a basic equation would ensure accounts are balanced, but an expanded equation would indicate how much of that balance was impacted by interest payments to shareholders. These retained earnings are what the company holds onto at the end of a period to reinvest in the business, after any distributions to ownership occur.