Though the NPV formula estimates how much value a project will produce, it doesn’t show if it’s an efficient use of your investment dollars. Because the equipment is paid for upfront, this is the first cash flow included in the calculation. No elapsed time needs to be accounted for, so the immediate expenditure of $1 million doesn’t need to be discounted. Mastering the NPV profile empowers decision-makers to assess investment opportunities rigorously.

Investment Appraisal

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Comparing NPVs of projects with different lifespans can be problematic, as it may not adequately account for the difference in the duration of benefits generated by each project. Another circumstance that may cause mutually exclusive projects to be ranked differently according to NPV and IRR criteria is the scale or size of the project. Thus, you can see that the usefulness of the IRR measurement lies in its ability to represent any investment opportunity’s possible return and compare it with other alternative investments. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

What is the importance of net present value in financial decision-making?

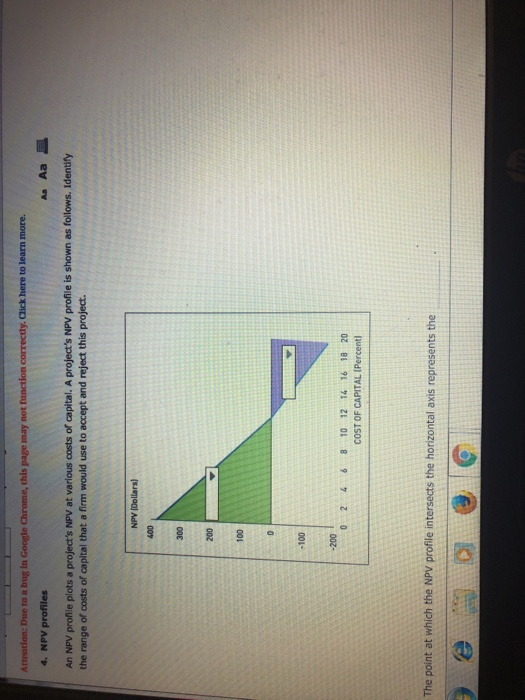

NPV(Net Present Value) profiles are used by the companies for capital budgeting. Capital budgeting is the process that the business uses to decide which investments are profitable. The motive of these businesses is to make profits for their investors, creditors, and others. This is only possible when the investment decisions they make results in increasing the equity. Other tools used are IRR, profitability index, payback period, discounted payback period, and accounting rate of return.

3: Net Present Value (NPV) Method

Calculating NPV involves computing the present value of each cash flow and then summing the present values of all cash flows from the project. This project has six future cash flows, so six present values must be computed. It empowers decision-makers to navigate the complex landscape of investments, combining financial rigor with strategic vision. As you embark on your next project evaluation, remember that the NPV profile is more than a graph—it’s a compass guiding you toward informed choices. The shape of the NPV profile indicates the sensitivity of the project’s profitability to changes in the discount rate. A steeper upward-sloping profile suggests that the project is more sensitive to changes in the discount rate, making it riskier.

It accounts for the fact that, as long as interest rates are positive, a dollar today is worth more than a dollar in the future. In the context of evaluating corporate securities, the net present value calculation is often called discounted cash flow (DCF) analysis. It’s the method used by Warren Buffett to compare the NPV of a company’s future DCFs with its current price. It is quite possible, although rare, for a project to have more than one IRR, or no IRR at all.

Net Present Value Profile: How to Use NPV Profile to Compare the Sensitivity of Investment Projects

One of the most common and useful ways to measure the performance of an investment is to calculate… This is depicted in the graph where the two lines of Project A and Project B meet.

Net present value, commonly seen in capital budgeting projects, accounts for the time value of money (TVM). The time value of money is the idea that future money has less value than presently available capital, due to the earnings potential of the present money. A business will use a discounted cash flow (DCF) calculation, which will reflect the potential change in wealth jury duty pay is taxable from a particular project. The computation will factor in the time value of money by discounting the projected cash flows back to the present, using a company’s weighted average cost of capital (WACC). A project or investment’s NPV equals the present value of net cash inflows the project is expected to generate, minus the initial capital required for the project.

This is also true in the real world when the discount rate increases, the business has to put more money into the project; this increases the cost of the project. The steeper the curve, the more the project is sensitive to interest rates. So, JKL Media’s project has a positive NPV, but from a business perspective, the firm should also know what rate of return will be generated by this investment.

- Combining it with other evaluation methods and considering qualitative aspects ensures a more holistic decision-making process.

- NPV is often preferred for capital budgeting because it gives a direct measure of added value, while ROI is useful for comparing the efficiency of multiple investments.

- Sensitivity analysis, often conducted alongside NPV profiling, sheds light on the robustness of investment decisions.

- Also, the NPV method can be problematic when available capital resources are limited.

- Poor corporate governance can also cause a company to ignore or miscalculate NPV.

When using the NPV profile to evaluate investment projects, it is important to consider the project’s specific requirements, risk tolerance, and strategic objectives. By comparing the NPV profiles of different projects, decision-makers can prioritize investments based on their financial viability and alignment with organizational goals. The NPV profile is a graphical representation of the net present value (NPV) of an investment project at different discount rates.

Finally, subtract the initial investment from the sum of the present values of all cash flows to determine the NPV of the investment or project. The internal rate of return (IRR) is calculated by solving the NPV formula for the discount rate required to make NPV equal zero. This method can be used to compare projects of different time spans on the basis of their projected return rates.

Assume the monthly cash flows are earned at the end of the month, with the first payment arriving exactly one month after the equipment has been purchased. This is a future payment, so it needs to be adjusted for the time value of money. An investor can perform this calculation easily with a spreadsheet or calculator. To illustrate the concept, the first five payments are displayed in the table below. Imagine a company can invest in equipment that would cost $1 million and is expected to generate $25,000 a month in revenue for five years.